Section 4a Income Tax Act

APPLICATION TO OFF-SHORE AREA. It is deadline before which any investments under Section 80C of the Income Tax Act 1961 must be made.

Income Exempted Taxact Tax Deductions List Money Financial

4A of section 80-IA.

. Income charged under section 583. Short title and commencement. 23FA any income by way of dividends other than dividends referred to in section 115-O.

However under section 9 of the income tax act other provisions lay down the criteria as to why certain incomes are deemed to accrue in India even though they might actually arise out of India. Income Tax Act 2007 is up to date with all changes known to be in force on or before 31 August 2022. Income Tax Act 1959.

Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 Under Proposed Regulations 113295-18 an excess deduction on termination of an estate or trust allowed in arriving at adjusted gross income Internal Revenue Code IRC section 67e expenses is reported as an adjustment to income on Forms 1040 1040-SR and 1040-NR. 2021-48 and which section of Rev. Without prejudice to the provisions of this Act where a person required to furnish a return of income under section 139 fails to do so within the time prescribed in section 1391 he.

Income from businesses where foreign exchange loss or gain is realized. Under Rule 4A of the Service Tax Rules 1994 it is compulsory for a service tax assessee to issue a bill or invoice within 14 days from the date on which the taxable service was completed or the date on which the payment was received for the service whichever comes first. Export processing zone.

Section 2792 of Income-tax Act empowers a Chief Commissioner of Director General of Income-tax to compound an offence either before or after the institution of prosecution proceeding. Adjustments under Subdivision 115-C or 207-B of the Income Tax Assessment Act 1997--references in this Act to assessable income under section 97. I Amount of fee payable for late filing of return of income Section 234F1.

Between October and November. For purposes of taxation of superannuation benefits taken to be quoted for surcharge purposes Division 4A--Quotation of tax file numbers in connection with farm management deposits 202DL. 1 Previous Next.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Payment to body outside the UK. As per Section 231 Person for the purpose of Income Tax Act includes inter alia a Local Authority.

Person liable for tax under section. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Charge to tax on income from sales of patent rights.

Section 12A enables non-profit entities such as Charitable Trusts Non-Profit Organisations Welfare Societies Religious Institutions etc to claim full tax. It will draw penalty as per the regulations mentioned in section 77. Income Tax 3 Issue 1 CHAPTER 470 INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Charge to tax on income from disposals of know-how. 2021-48 you are applyingeither section 3011 2 or 3. For the purpose of section 1020 which provides for exemption of income of Local Authority subject to certain conditions the expression Local Authority means i Panchayat as referred to in clause d of Article 243 of the Constitution.

Due date to file income tax return. Section 5431i and j. Exceptions to charge under section 583.

For any intentional mistakes or omissions and for any fraudulent filing penalty will be imposed on the tax payer. Shall be deemed to be salary or wages income taxable at the rate declared by Section 12 of the Income Tax Salary or Wages Tax Rates Act 1979. Tax year in which certain expenditure treated as incurred.

INCOMES WHICH DO NOT FORM PART OF TOTAL INCOME. Income Tax Act 1959 No. Income Tax E-filing Due Date.

4A or 1394B or 1394C or 1394D or 1394E or 1394F ITR-V. Tax returns must be verified by this time. The Form ITR 7 for person including companies which are required to furnish return under Section 1394A or 1394B or 1394C or 1394D or 1394E or 1394F of the Income Tax Act.

Income charged under section 587. Statements or certificates deliver de-claration allow inspection etc under sections 133 134 1394A 1394C 1922C 197A 203 206 206C 206C1A. 5 Section 1394a Income Tax Return of Charitable and Religious Trusts.

Sales of patent rights. PART II IMPOSITION OF INCOME TAX 3. This form is for persons including companies under section 1394A 1394B 1394C and 1394D in respect of furnish return.

Section 1395 is specifically applicable to cases of Omissions and Wrong Statements and not meant for Concealment or False Statements. There are changes that may be brought into force at a future date. Section - 10 Income-tax Act 1961-2019 No.

Person liable for tax under section 583. Once the Trust organisation or NGO is established they have to register as per Section 12A of the Income Tax Act for claiming exemption under Section 11 and 12 of the Income Tax Act. If you have tax-exempt income resulting from the forgiveness of a PPP Loan attach a statement to your return reporting each taxable year for which you are applying Rev.

To Email Your Name Your Email Message. Additional sales use and casual excise tax imposed on certain items. Beginning June 1 2007 an additional sales use and casual excise tax equal to one percent is imposed on amounts taxable pursuant to this chapter except that this additional one percent tax does not apply to amounts taxed pursuant to Section 12-36-920A the tax on.

Health Insurance Tax Benefits Health Insurance Plans Health Insurance Health Insurance Benefits

Which Is The Best Return Form For You To File Income Tax Return Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students

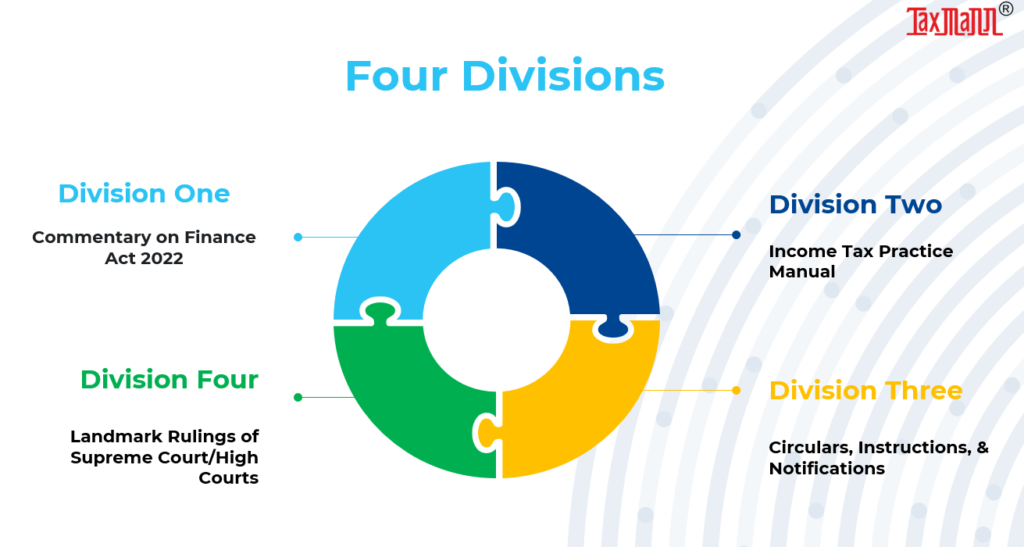

How To Do Income Tax Research Using Master Guide To Income Tax Act

Taxation Principles Dividend Interest Rental Royalty And Other So

Comments

Post a Comment